Across the Caribbean, digital tools are increasingly part of how people work, trade, send money home, and build small enterprises. Over the past two to three weeks, global cryptocurrency markets have experienced a series of historic moves that signal a deeper shift in how digital assets are being positioned within the global financial system. For Small Island Developing States, these developments are not abstract market noise. They have direct implications for financial resilience, digital transformation strategy, and governance-led innovation.

This moment sits squarely at the intersection of Caribbean digital transformation advisory, financial inclusion, and risk-aware technology adoption. Understanding what has happened, and why it matters, is now a productivity issue, not a speculative one.

What Changed in the Crypto Markets

In the last few weeks, three developments stand out. First, Bitcoin has experienced sharp price movements around historically significant levels, driven less by retail speculation and more by institutional positioning. Major listed firms increased their Bitcoin holdings, while regulated exchange-traded products linked to digital assets recorded substantial capital inflows. This behaviour signals that crypto is being treated increasingly as a strategic asset class rather than a fringe investment.

Second, regulators in major markets have begun refining their oversight frameworks. Updates from US regulatory bodies and policy signals from central banks have reduced uncertainty around custody, settlement, and market structure. While not deregulatory, these changes point toward formal integration rather than exclusion of digital assets from the financial system.

Third, stablecoins and tokenised dollar instruments have quietly gained traction as transactional tools. Trading volumes and settlement use cases expanded even as prices fluctuated, reinforcing that crypto’s utility layer is now distinct from speculative price cycles.

Why These Moves Matter to Caribbean Economies

For Caribbean economies, crypto volatility often grabs headlines, but the deeper signal lies in institutional behaviour and infrastructure maturity. Small economies are highly sensitive to external shocks, correspondent banking constraints, and foreign exchange friction. Digital assets, when governed properly, offer optionality rather than replacement.

Recent market moves suggest that global finance is preparing for a future where blockchain-based rails coexist with traditional systems. This matters for the Caribbean because it aligns with ongoing needs around cross-border payments, remittances, and trade settlement. In many islands, transaction costs remain disproportionately high relative to income levels, and delays impact small businesses more than large firms.

From a decision intelligence consulting Caribbean perspective, the signal is clear. Crypto is no longer just a technology conversation. It is a data, governance, and operating model question.

Risk, Governance, and Public Sector Implications

The past few weeks have also reinforced the importance of governance-led digital transformation. As global regulators clarify their stance, Caribbean governments and financial institutions face a narrowing window to define their own frameworks. Waiting carries risk, but moving without guardrails carries greater risk.

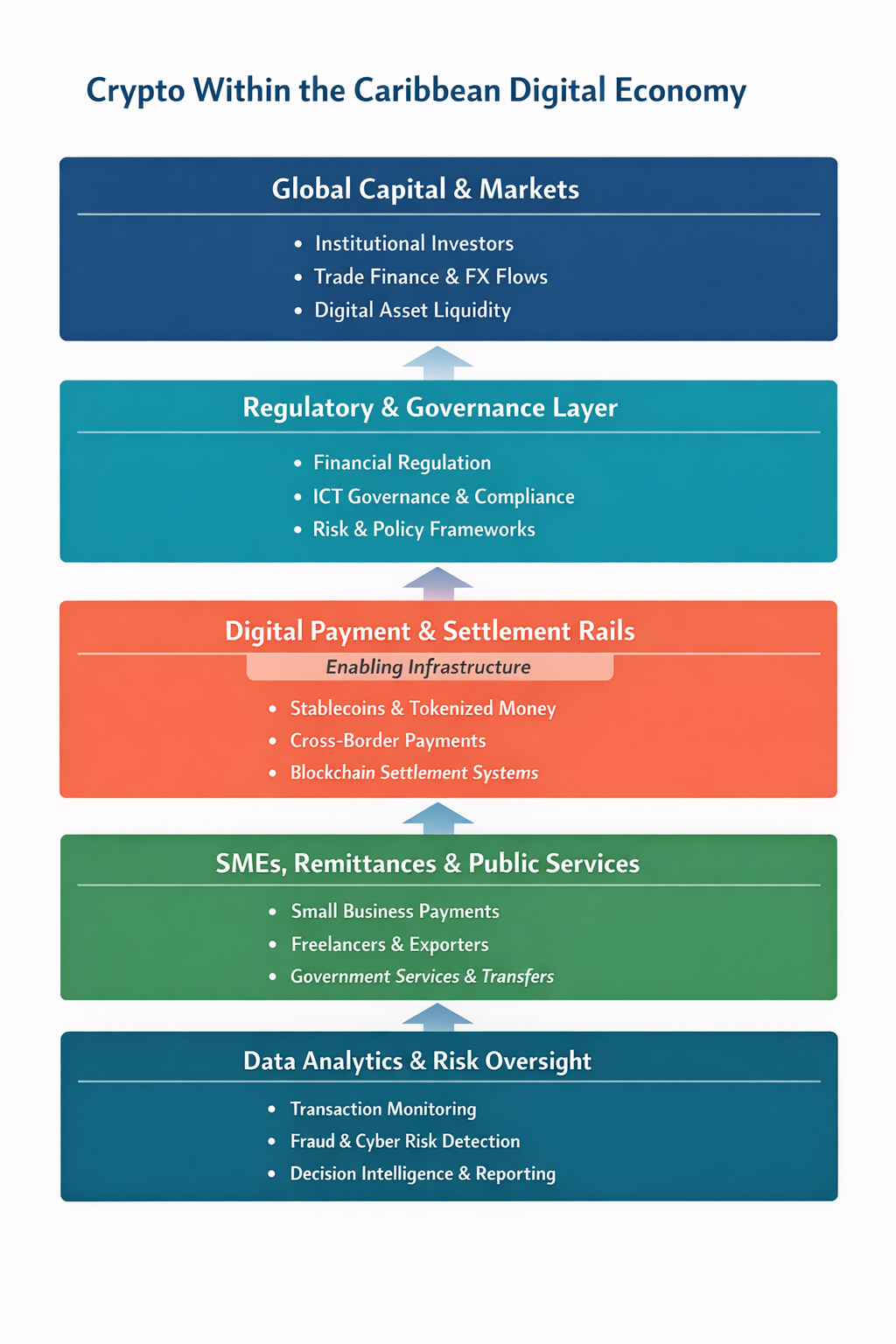

Public sector digital transformation in the Caribbean must therefore focus on three areas. First, regulatory clarity around digital assets, stablecoins, and custody. Second, institutional capacity to monitor and analyse blockchain-based activity using modern data analytics. Third, alignment with existing ICT governance and financial oversight structures.

This is where ICT governance advisory Caribbean and enterprise data strategy become decisive. Crypto adoption without governance exposes states to compliance, reputational, and financial stability risks. Crypto adoption with governance creates resilience.

Opportunities for Small Businesses and Entrepreneurs

For Caribbean entrepreneurs and SMEs, recent crypto market moves highlight opportunity with caution. Stablecoins and regulated platforms are increasingly being explored for cross-border invoicing, freelance payments, and e-commerce settlement. These tools can improve cash flow velocity, reduce dependency on intermediaries, and support digital-first business models.

However, volatility, cybersecurity risk, and regulatory uncertainty remain real. Businesses that treat crypto as infrastructure rather than speculation are better positioned. This requires digital literacy, risk awareness, and alignment with local financial regulations.

Recommended Reading: The Future of Money by Eswar Prasad

A highly relevant read for this moment is The Future of Money by Eswar Prasad. The book explores how cryptocurrencies, central bank digital currencies, and fintech are reshaping the global monetary system. Prasad provides a balanced, evidence-based view that avoids hype while clearly outlining the strategic implications for governments, small economies, and financial institutions.

For Caribbean leaders, the book offers valuable context on why digital money is less about technology novelty and more about governance, trust, and institutional readiness.

From Market Signals to Strategic Action

The historic crypto moves of the past few weeks are not about price alone. They signal a maturing asset class, deeper institutional involvement, and a narrowing gap between traditional finance and digital rails. For Caribbean small economies, the question is no longer whether crypto matters, but how it is governed, integrated, and leveraged responsibly.

A practical next step for policymakers and institutions is to visualise crypto within the national digital ecosystem.

References

- Reuters. (2024–2025). Coverage on cryptocurrency markets, institutional adoption, and regulatory developments.

- International Monetary Fund. (2023). Global Financial Stability Report.

- Bank for International Settlements. (2023). Annual Economic Report.

- World Bank. (2022). Distributed Ledger Technology and Financial Inclusion.

- Prasad, E. (2021). The Future of Money. Harvard University Press.